Weekly NASDAQ Update: +27% Annual Returns Since 1999 – Here’s What the Model Says Now

Our Tactical NASDAQ Model turned $10K into over $5 million with 27% annual returns since 1999 — crushing the NASDAQ. This week’s update reveals the model’s current position, market signals, and more.

📅 Date: 19.04.2025

The NASDAQ-100 closed the week down approximately 2.6%, finishing at 18,258, extending its year-to-date decline to around 15.5%. The market came under pressure from renewed trade tensions and shifting expectations around monetary policy.

Semiconductor stocks led the decline after the U.S. announced new export restrictions targeting chip sales to China, which weighed heavily on names like NVIDIA and other high-beta tech components. Meanwhile, Fed Chair Jerome Powell signaled that the central bank needs greater clarity before considering any rate cuts, especially in light of inflation risks stemming from potential new tariffs.

Volatility remained elevated, with the VIX trading above its 50-day average, reflecting increased investor uncertainty. Overall, the week was marked by risk-off sentiment as traders reacted to a mix of geopolitical concerns and cautious central bank messaging.

Each week, I share a tactical update on what the model is doing right now — and why. But beyond the signals and allocations, it’s just as important to understand how the system thinks.

That’s why I’ve launched a new series: Inside the Model — a deep dive into the rules, metrics, and mindset behind the strategy.

If you’ve ever wondered why the win rate is low, why we sit in cash, or why we don’t rotate into bonds or inverse ETFs — this is where you’ll find the answers. The first episode will get live on Monday.

🆓 Public Section – Backtest & Model Performance 📊

How The Nasdaq Tactical Model Has Performed Over Time

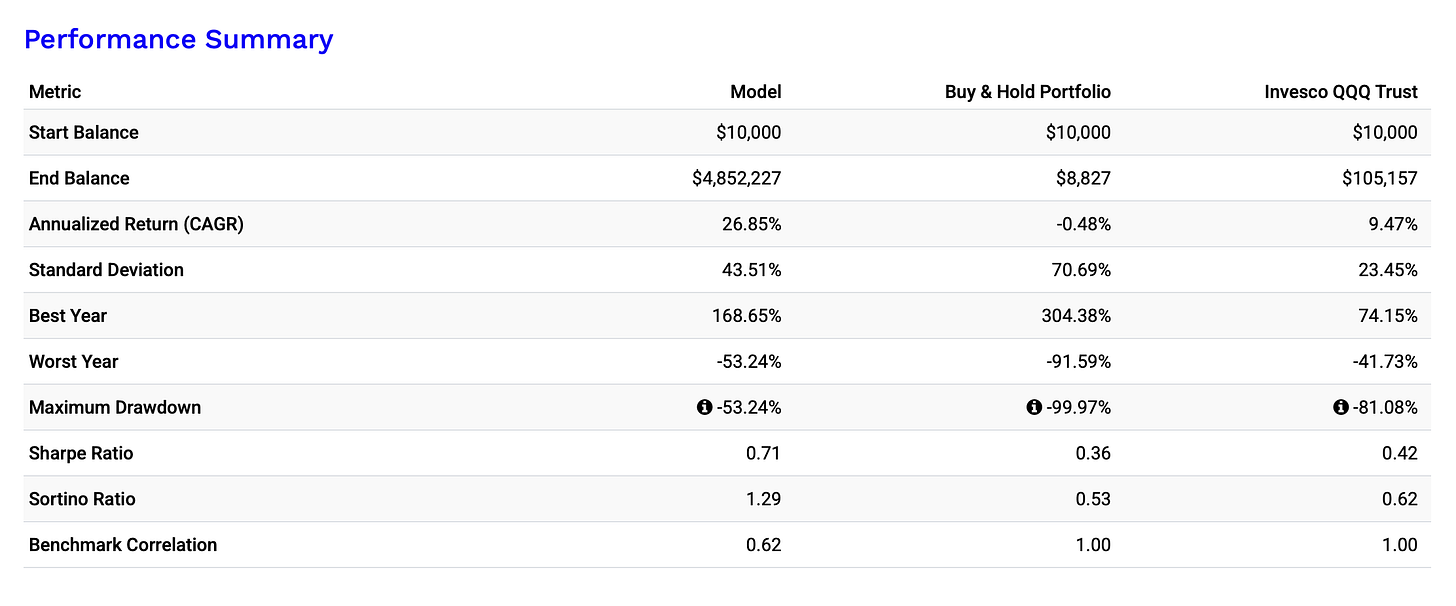

Every week, I share an updated look at how my Nasdaq Tactical Strategy has performed in historical backtests. This ensures full transparency and allows you to compare the strategy's results against traditional Buy & Hold investing.

📊 Backtest Results (1999-2025):

💡 Why This Works

Unlike traditional investing, this model avoids catastrophic losses by dynamically shifting between 3x leveraged Nasdaq ETFs (TQQQ/3QQQ) and cash (T-Bills) when the trend weakens. I chose the worst start time in NASDAQ history, just before the dotcom bubble burst. However, the performance is tremendous.

✅ Survived the Dotcom Bubble (-29% vs. -99%)

✅ Handled 2008 better than Buy & Hold (-34% vs. -93%)

✅ Managed 2022 tech sell-off with controlled losses (-46%)

Here you can see the incredible performance:

and the annualized outperformance for the last 25 Years compared to the QQQ:

📢 Every week, I share fresh backtesting insights to ensure that this strategy remains one of the most robust in the market.

🚀 Exclusive Content – Only for Premium Subscribers

👉 Upgrade to Premium to unlock my latest market insights, portfolio breakdowns, and trade signals!

🔒 This Week’s Premium Section Includes:

✅ 📊 My Current Portfolio & Allocation – What I’m holding & why

✅ 📉 Market Trends & My Technical Analysis – Where the Nasdaq is heading

✅ 🔍 Next Trade Signals – Key price levels that will trigger action

🔒 Premium Section

Portfolio Breakdown & Market Outlook

Keep reading with a 7-day free trial

Subscribe to The Nasdaq Playbook to keep reading this post and get 7 days of free access to the full post archives.