Weekly NASDAQ Model Update: +27% Annual Returns Since 1999 – Here’s What the Model Says Now

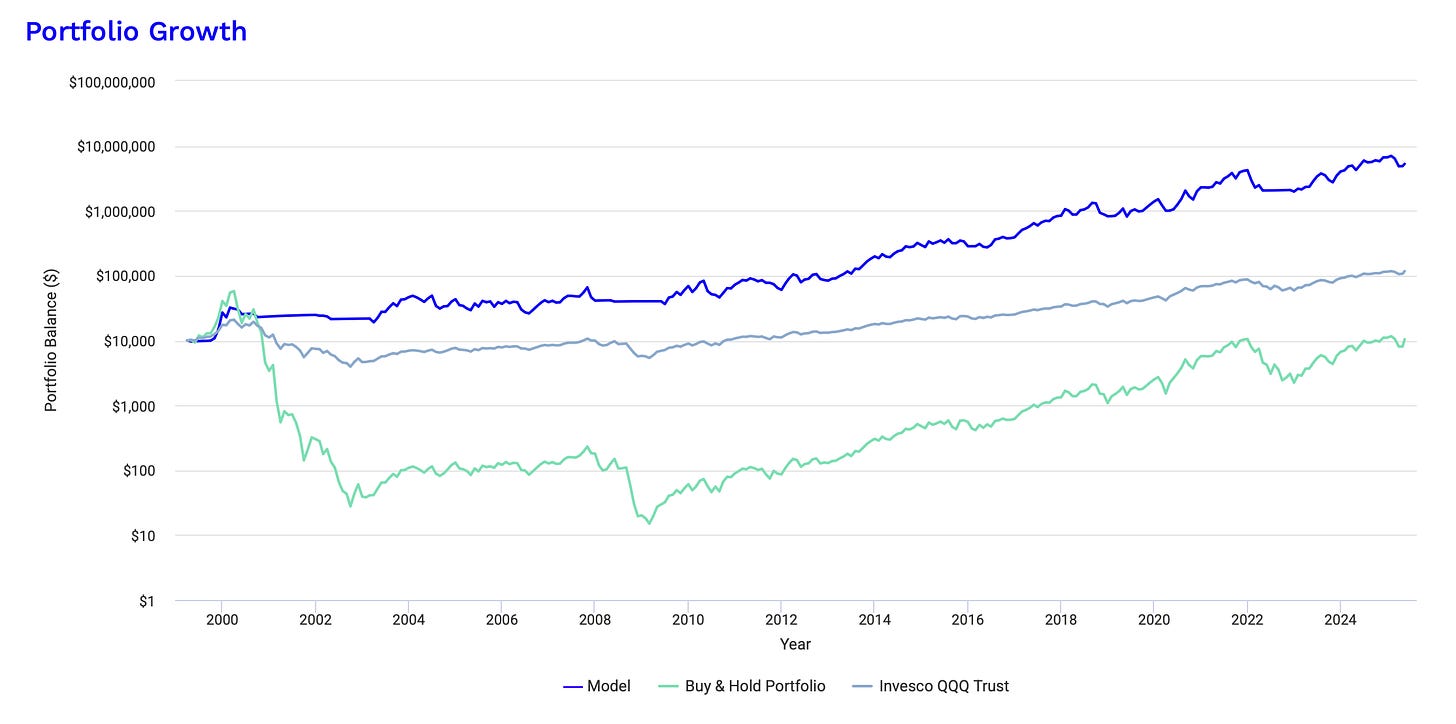

Our Tactical NASDAQ Model turned $10K into over $6 million with 27% annual returns since 1999 — crushing the NASDAQ. This week’s update reveals the model’s current position, market signals, and more.

📅 Date: 02.08.2025

Markets are currently sitting at elevated valuation levels, with many key indices, especially in tech, trading well above their long-term valuation averages. This creates an environment where downside risk is significantly higher than usual. Not only are forward P/E ratios stretched, but we’re also seeing tightening financial conditions due to rising real yields. Meanwhile, market leadership has become increasingly narrow, concentrated in just a handful of mega-cap stocks, leaving the broader market vulnerable. Volatility metrics are beginning to show early signs of stress, even as retail sentiment remains broadly optimistic.

In such an environment, relying on emotion, opinion, or short-term narratives can be dangerous. What’s needed instead is a robust, rules-based system—one that’s been tested across multiple cycles and designed not just for upside participation, but for capital preservation during drawdowns. That’s exactly what our model delivers. By combining multiple, independently weighted signals across trend, volatility, and momentum structures, it dynamically adjusts to changing market conditions in real time.

This week’s update continues to reflect that philosophy in action. Let’s take a closer look.

🔥 Still on the sidelines? You're not alone — but they're moving.

Over 250 active subscribers now follow this model. Why? Because it doesn't just talk returns.

It’s documented, audited, and has delivered:

✅ +27.2% annualized returns (since 1999)

✅ Through dot-com, GFC, COVID, and 2022

✅ With lower drawdowns and fewer trades than almost any tactical system out there

"I thought it was hype too — until I downloaded the full backtest. Now I just follow the signal."

– M. Ryan, Paid Subscriber

📊 No fluff. No noise. Just data.

Skeptical? Good. You should be. That's why we publish an independent backtest.

Same logic. Same signals. No black box.

📊 Backtest Results (1999-2025):

Here you can see the incredible performance:

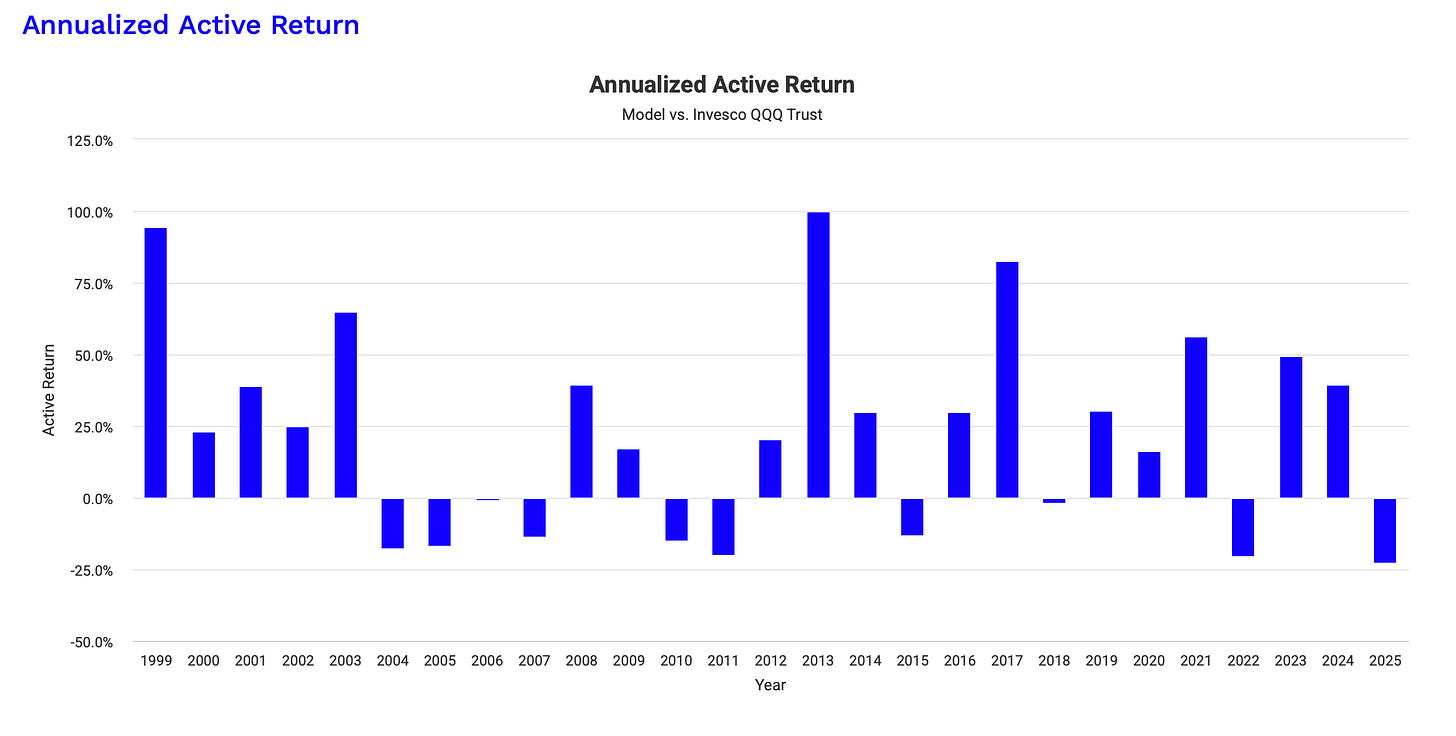

and the annualized outperformance for the last 25 Years compared to the QQQ:

If you're serious about compounding wealth with discipline, now’s the time.

🟢 $0.60 a day.

🟢 Cancel anytime.

🟢 Join hundreds who stopped guessing — and started operating.

Let’s get into the signal.

🔑 Paid Subscribers Only

💼 Current Portfolio Allocation

Here’s how the three models are currently positioned:

Keep reading with a 7-day free trial

Subscribe to The Nasdaq Playbook to keep reading this post and get 7 days of free access to the full post archives.