Weekly NASDAQ Model Update: +27% Annual Returns Since 1999 – Here’s What the Model Says Now

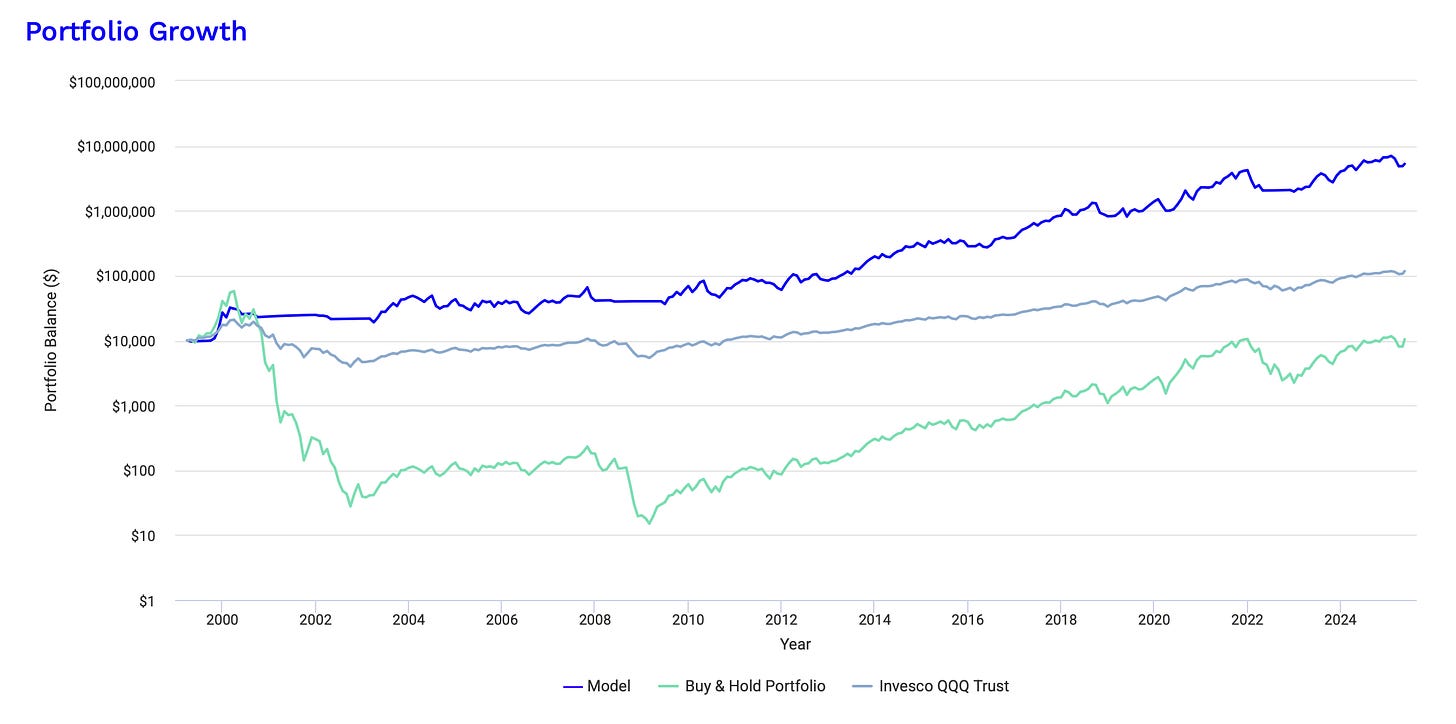

Our Tactical NASDAQ Model turned $10K into over $6 million with 27% annual returns since 1999 — crushing the NASDAQ. This week’s update reveals the model’s current position, market signals, and more.

📅 Date: 26.07.2025

📊 Nasdaq‑100 Weekly Recap

📌 Index Level: Closed at 23,272.25, unchanged on the final day, after rising approximately +0.3% earlier in the week.

📈 Weekly Return: The Nasdaq‑100 advanced around +0.8%, marking its fifth straight weekly gain.

🔍 Momentum & Breadth: Despite hitting new highs, momentum slowed mid-week. Volume declined, and market breadth narrowed, with mega-cap tech names like Nvidia, Microsoft, Amazon still leading.

📉 Volatility & Sector Rotation: The VIX rose slightly, reflecting cautious sentiment ahead of earnings. Utilities outperformed while energy lagged. Gains in financials and utilities offset weakness in energy and consumer-select names.

🧭 Technical Structure: The index remains decisively above its 20‑, 50‑ and 200‑day moving averages, but some analysts warn of resemblance to 1999’s extended high run.

⏳ Earnings Focus: Investor attention pivots to Apple and Alphabet releases next week — key to shaping the next directional move amid trade tension headlines.

🔥 Still on the sidelines? You're not alone — but they're moving.

Over 250 active subscribers now follow this model. Why? Because it doesn't just talk returns.

It’s documented, audited, and has delivered:

✅ +27.2% annualized returns (since 1999)

✅ Through dot-com, GFC, COVID, and 2022

✅ With lower drawdowns and fewer trades than almost any tactical system out there

"I thought it was hype too — until I downloaded the full backtest. Now I just follow the signal."

– M. Ryan, Paid Subscriber

📊 No fluff. No noise. Just data.

Skeptical? Good. You should be. That's why we publish an independent backtest.

Same logic. Same signals. No black box.

📊 Backtest Results (1999-2025):

Here you can see the incredible performance:

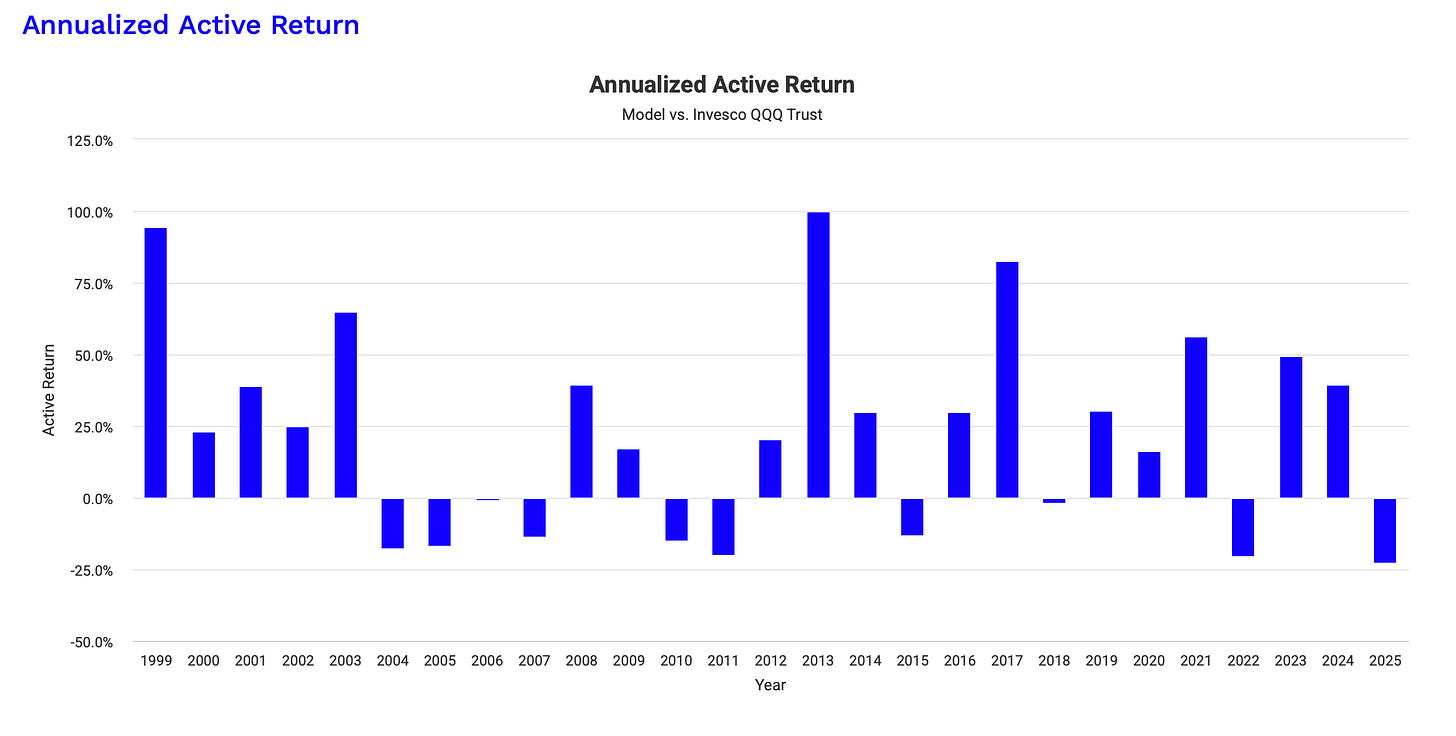

and the annualized outperformance for the last 25 Years compared to the QQQ:

⚙️ The signal just updated.

The new allocation, system trigger, and model rationale are all live — but only for paid subscribers.

If you're serious about compounding wealth with discipline, now’s the time.

🟢 $0.60 a day.

🟢 Cancel anytime.

🟢 Join hundreds who stopped guessing — and started operating.

Let’s get into the signal.

🔑 Paid Subscribers Only

💼 Current Portfolio Allocation (as of July 26, 2025)

Here’s how the three models are currently positioned:

Keep reading with a 7-day free trial

Subscribe to The Nasdaq Playbook to keep reading this post and get 7 days of free access to the full post archives.