Weekly Update – August 16, 2025: 250+ Investors Followed the Signals. Here’s What Changed This Week

Our Tactical NASDAQ Model turned $10K into over $6 million with 27% annual returns since 1999 — crushing the NASDAQ. This week’s update reveals the model’s current position, market signals, and more.

📅 Date: 16.08.2025

The Nasdaq-100 extended its recovery this week, finishing +0.35% higher at 23,712, after setting a fresh all-time high at 23,839 on Tuesday, August 12. While some mega-cap tech names showed mixed performance, the broader index held firm, underscoring the resilience of the sector.

Across U.S. equities, the tone was constructive: the S&P 500 gained -0.29%, while the Dow Jones advanced +0.078%.

Against this backdrop, our systems executed one tactical trade — a reminder that the multi-model structure becomes particularly active when markets enter phases of heightened momentum and conviction.

🔥 Still on the sidelines? You're not alone — but they're moving.

Over 250 active subscribers now follow this model. Why? Because it doesn't just talk returns.

It’s documented, audited, and has delivered:

✅ +27.2% annualized returns (since 1999)

✅ Through dot-com, GFC, COVID, and 2022

✅ With lower drawdowns and fewer trades than almost any tactical system out there

"I assumed it was marketing hype. Then I studied the backtest myself. Now I don’t question the signals I just execute them."

— J. Mogan, Paid Subscriber

📊 No fluff. No noise. Just data.

Skeptical? Good. You should be. That's why we publish an independent backtest.

Same logic. Same signals. No black box.

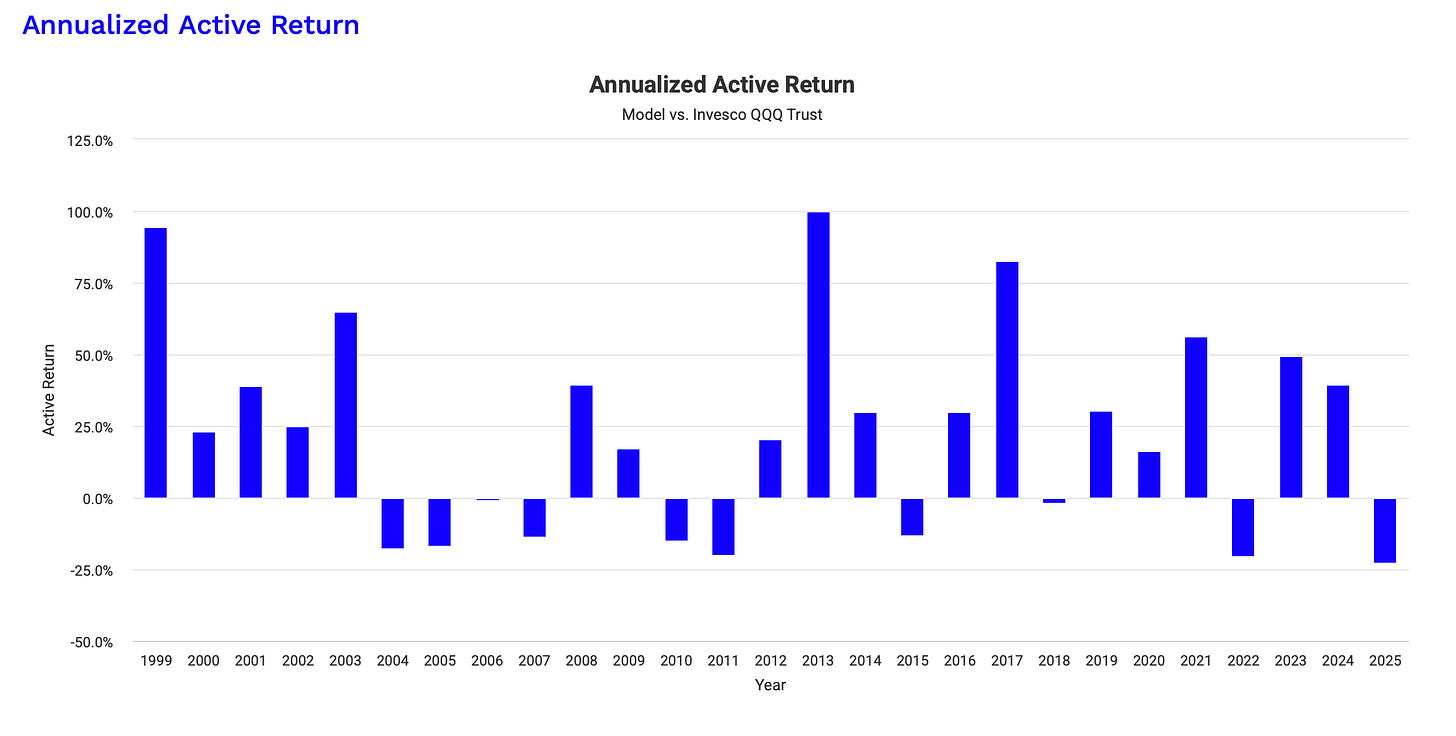

📊 Backtest Results (1999-2025):

and the annualized outperformance for the last 25 Years compared to the QQQ:

If you're serious about compounding wealth with discipline, now’s the time.

🟢 $0.60 a day.

🟢 Cancel anytime.

🟢 Join hundreds who stopped guessing — and started operating.

Let’s get into the signal.

🔑 Paid Subscribers Only

💼 Current Portfolio Allocation

Here’s how the three models are currently positioned:

Keep reading with a 7-day free trial

Subscribe to The Nasdaq Playbook to keep reading this post and get 7 days of free access to the full post archives.