Hey,

Here's a newsletter we've been following ourselves, Money Machine Newsletter.

It’s designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here.

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

THIS tiny pill is threatening to end a HUGE monopoly.

If THIS keeps growing, your paycheck might not.

A 20-year trend just broke (billions of dollars pouring in).

Betting $5K in Vegas to save a startup (now worth $90B).

And more. Let’s get to it!

Top Insights of the Week

1. 💊 THIS Tiny Pill Packs a Big Disruption

Ozempic and Mounjaro dominate weight loss—if you’re okay with a weekly jab. But orforglipron? It’s weight loss in a pill. No needles. No fridge.

Orforglipron is Eli Lilly’s oral GLP-1 drug. A daily pill that does what the big-name injectables do, minus the medical routine.

Real weight loss (~16 lbs in trials). Same outcome. Less hassle.

Here’s the stat most people miss… this is the first time a non-peptide, small-molecule GLP-1 drug has shown this level of clinical effectiveness… that’s not a tweak… that’s a leap.

If this gets approved—and it’s on track for obesity in 2025, diabetes in 2026—access explodes. It becomes easier to produce. Easier to distribute. Easier for millions of people to say “yes.” And it threatens to break the monopoly of injectables.

Today it’s a pill. Tomorrow? Maybe a patch. A nasal spray. A dissolvable strip. Who knows… one thing is certain… once the biology is cracked and the molecule’s small enough, delivery becomes a design problem. And design problems get solved. So while everyone’s watching the needle…you might want to watch the pill.

2. 🌎 The Web Is Turning Into Leftovers

Ten years ago, Google read two of your pages for every one visitor it sent your way. Now? Google reads 18 pages to send you one. OpenAI? 1,500 to 1. Anthropic? 60,000 to 1. That’s the new internet…

We’re not writing for people anymore. We’re writing for bots. They read everything. Summarize it. Spit it out. No link. No credit. No traffic. No paycheck. Publishers are getting scraped dry.

Cloudflare’s CEO called it an an “existential threat” to publishers. His solution? Block the bots. Make them pay to play. And everyone from The New York Times to your favorite blog seems to be on board.

Will it pick up steam? No one knows yet. But if creators stop getting paid, they stop creating. And what’s left? A web full of leftovers.

3. 😳 Woah. A 20-Year Trend Just Broke

What do LeBron James and a pipe valve company have in common? They were both part of a quiet ~$31B deal streak in June…

Qualcomm bought Alphawave for $2.4B. Chart merged with Flowserve for $19B. The Lakers? Sold for $10B. Deals are back. Big time.

Why now? Because the ref changed…

For years, M&A felt like walking through glue. IPOs stalled, with deal counts reaching their lowest level in 20 years. Regulators were on high alert. Lina Khan’s FTC had companies scared to move.

But now she’s out. Andrew Ferguson’s in—more business-friendly, less red tape. And just like that, the floodgates opened.

IPOs? Up big. CoreWeave jumped 4x. Circle soared 6x. Chime popped. M&A? Same story. Google bought Wiz for $32B. Salesforce bought Informatica for $8B. OpenAI bought io for $6.5B.

The money that’s been sitting on the sidelines? It’s back on the field. But it’s not buying the old stuff. Legacy SaaS and S&P 493? Meh. The heat’s in AI. In crypto. In vertical software getting rebuilt from scratch. That long, boring stretch we just went through? That chapter’s closed… for now.

Top 3 Charts of the Week

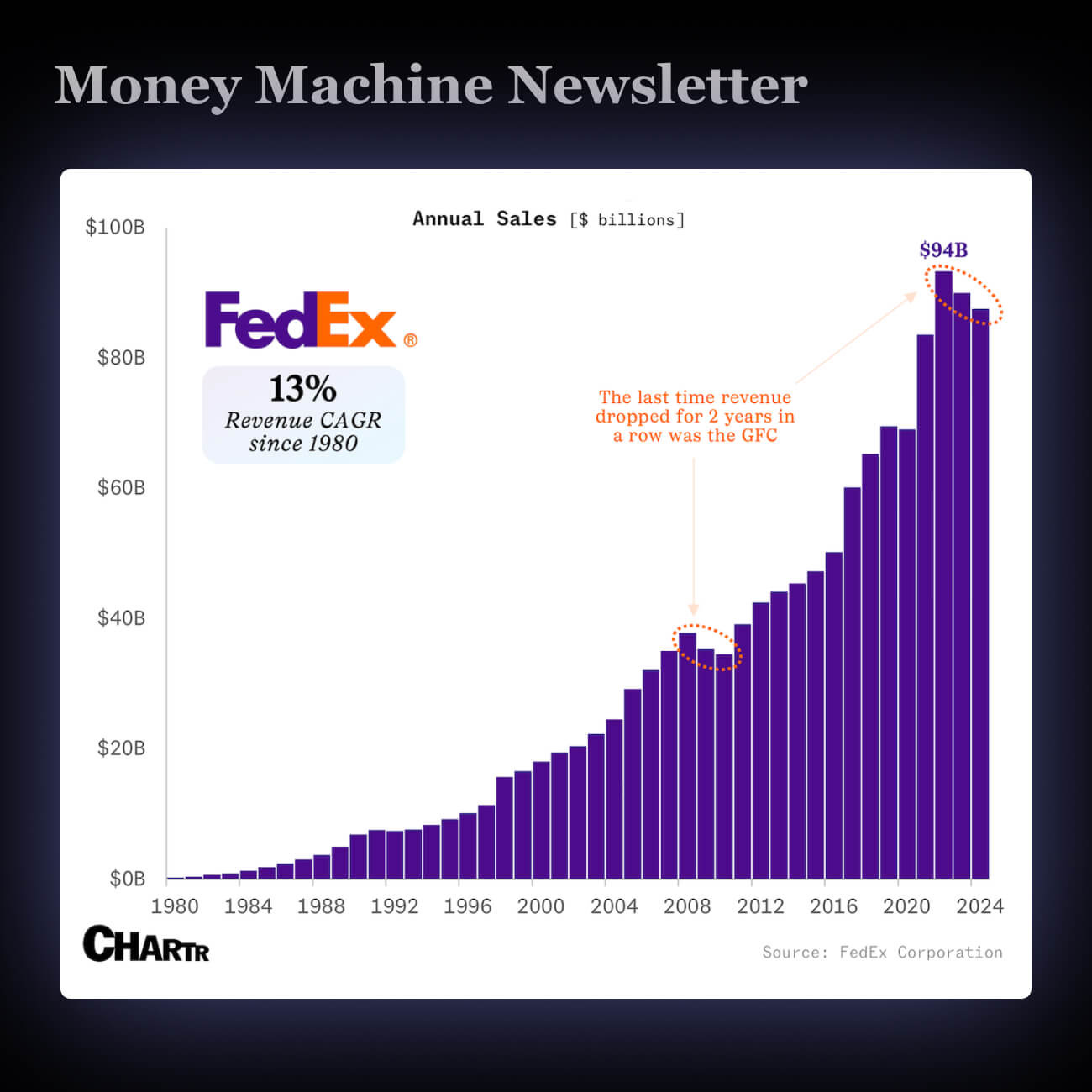

1. 📦 FedEx Has A Remarkable Track Record Of Delivering Solid Growth

Fred Smith, the founder of FedEx, has died at 80. He started the company with a school paper, a Marine mindset, and once kept it alive by gambling $5,000 in Vegas.

Smith built FedEx into a $90B-a-year delivery empire with over 500,000 workers. His grit turned a shaky startup into a global giant, though Amazon’s growing delivery biz is now a real threat.

2. 🍎 Apple's Reportedly Considering Buying Perplexity, Would Be Biggest Ever Acquisition

Apple’s falling behind in AI. Now it’s eyeing Perplexity AI—a red-hot search startup—as a possible way to buy its way back into the game.

Apple might break its usual playbook. It rarely makes big acquisitions, but Perplexity’s $14B+ price tag could push it to act differently this time.

This could shake up the search market. Apple’s $20B Google deal is under threat. If it builds its own AI search tool, the whole power structure of the internet shifts.

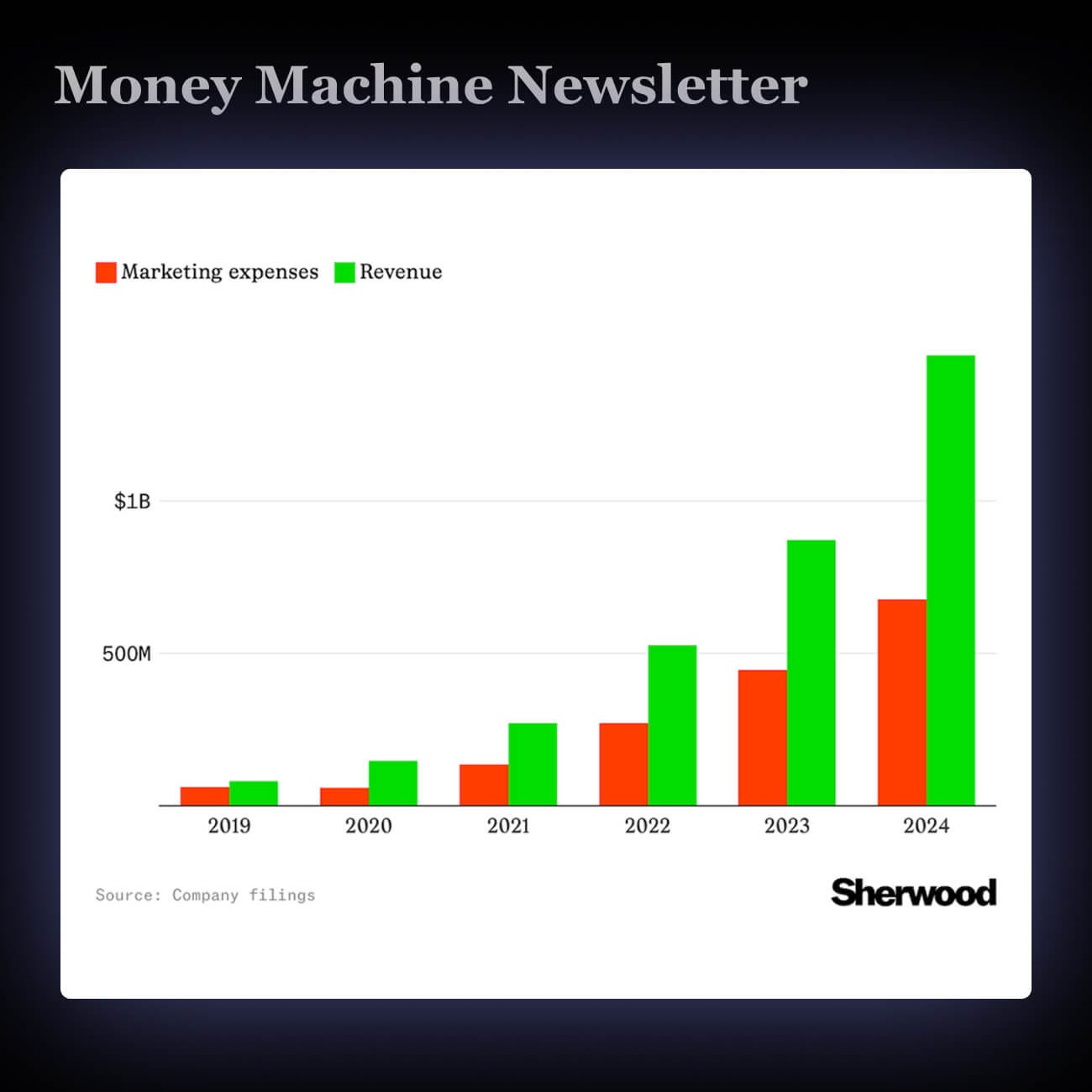

3. 💵 Hims & Hers Spends About Half of Its Revenue on Marketing Each Year

Telehealth brands like Hims, Ro, and BlueChew are remixing standard ED drugs—adding vitamins, candy flavors, or blending meds—to make their own custom, branded pills.

These aren't just health companies—they're marketing machines. Custom pills boost profits and keep customers hooked longer than generic meds ever could.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

See you in there!

Best,

Money Machine Newsletter

Nothing in this email is intended to serve as financial advice. Do your own research.

Subscribe to Money Machine Newsletter

Hundreds of paid subscribers

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered every Monday to your inbox before the market opens.